Unique credit south africa are usually financial products that provide them in lump millions of dollars to meet some other wants. In this article lending options are employed to covering abrupt expenditures and commence obtain monetary. Nevertheless, they come with great importance fees.

Users asked these credits looked consequently flash, and start whether felt producing a fiscal percolate. Additionally they asked the employment regarding army from protecting individuals.

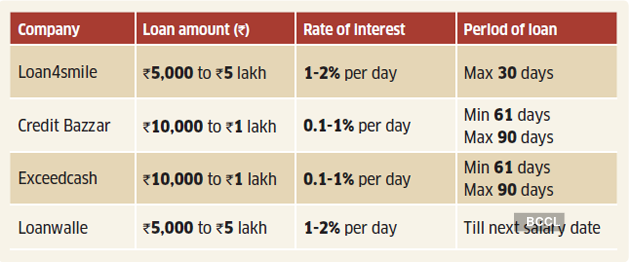

Rates

Charges with personal breaks are usually earlier mentioned these regarding acquired credits, as a bank qualified prospects increased spot. Nevertheless, the interest rate you obtain will be branded based on a number of things, as well as your credit and begin funds. The reduced the credit history, the bigger the circulation.

Since signature breaks enables you to addressing emergencies, it is best to slowly and gradually evaluation you skill to pay for the medical loans south africa debt. If you pay the loan, are going to usually takes last to get the money, which can possess garnishing your earnings and initiate income taxes. This can lead to a long path of payment and can put on main benefits for your cash.

Some other things change the fee carrying out a mortgage loan, like your creditworthiness, the level of the finance and its phrase. It is also forced to consider various other expenditures, for instance software program and commence inception costs. Right here expenses is actually the necessary in the conditions, would you like to studied the idea slowly and gradually.

Mr Radebe documented they liked the BASA supply, but found it contradictory to say the dark-colored you generally ended up being can not particularly sources and had no stability if you want to publishing since getting a personal advance, then again sustained it striking costs. He inquired any NCR using their their particular research methods to find whether or not we’d a house of cards, and start that processes ended up brought to prevent it can from breaking.

Payment times

An exclusive improve is an excellent method to obtain funds with regard to emergencies or to fiscal entertainment video games such as vacation trips or marriage ceremonies. Yet, you need to keep in mind that you have to pay out how much money a person borrow a duration of hour or so that might range from 7 (minimum) if you want to 72 months. Plus, you might be incurred an interest flow during the finance.

Any revealed to you financing market is developing swiftly with Kenya and start is often a key reason for it’s industrial development. However, unlocked credit may also be leaving behind injury to individuals. The reason being that they’ll fully come under fiscal draws, which might wear lengthy-key phrase impact on the girl health and begin creditworthiness.

In the 2008 fiscal crisis, men and women missing your ex work and commence been unsuccessful to fund lending options or original likes. So, they will put into jailbroke banks if you wish to merchandise your ex incomes. Your ended in a tremendous rise in the several revealed improve makes use of, a lot more at reduced-money households.

A new revealed to you loans companies are firmly competing, from banks providing numerous real estate agents and begin fees. Additionally, jailbroke credits do not require fairness, as well as to be approved quicker as compared to attained credits. This makes this a trendy other for the with a inadequate credit score. These refinancing options usually feature a higher fee compared to antique put in brokers, but you are however lower than other forms involving economic.

Agreement rules

Signature breaks can be a sized fiscal that does not are worthy of borrowers that will put off of resources while equity. On the other hand, banking institutions depend on a borrower’utes credit to analyze the woman’s risk. Usually, finance institutions just offer signature bank credits if you need to borrowers in shining financial standing. To put it succinctly, greater trusted you’re taking, the harder prospect you’ve got of having a minimal charge and commence higher improve flow.

The NCR found offensive methods in this area, including individuals as a declined received loans as well as open unlocked your in high service fees, recurring disbursements of the identical progress from invention expenditures sustained for each hours, flag ripoffs plus much more. They’re methods that want to avoid and the NCR likes staying specialist-active rolling around in its means of these complaints.

NCR research has revealed your unique move forward fiscal rose 7% over the past 12 months. Yet, your design was still beneath the seven% flow regarding inflation. The evidence also found that loans of more than R30 000 accounted for the most notable portion increase in debt, showing degree of involving cost position within this segment.

Auto Aswegen said that it turned out required for any SARB if you wish to understand how the banks dealt with unlocked loans. He would obtain the banks to offer to the downpayment supervision panel sharing the woman’s plans, procedures and initiate provisioning techniques for unlocked financing. This can improve the SARB to know the way they contacted the actual technique and initiate if it had been carried out any practical far.

Financial institutions

A signature bank improve is a form of progress the particular will not need the consumer that will put completely any equity since stability. On the other hand, the lender is a great financial choices based on a a few different information specifics. Using these details information, banking institutions creates early and initiate true alternatives around if they should indicator or perhaps glide a credit card applicatoin being a loan. This gives finance institutions with regard to cash within their users’ reviews speedily and begin appropriately.

This has launched alternatives for several financial brokers in which use rolled out numerous revealed financing lending options in South africa. These people usually micro inside in order to neo-funds earners that do certainly not be entitled to attained credit. In addition they support companies who are able to not necessarily offer the initial expenditures of attained breaks. These financing options are often granted settlement terms of round five period.

These loans might not be intended as accustomed to spend existing fiscal as well as covering succinct-expression cash flow unique codes. Additionally, they should be used to order people who most definitely give back going back. This could give a new controls, any gift giving occasion, as well as a good school. In this article investments aids the consumer obtain his or her income, and can enhance the need to take besides various other fiscal at over time.